Real estate transfer tax proposal returns, likely for purchases of $1 million or more

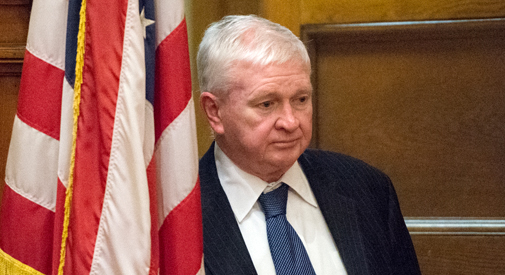

City councillor Tim Toomey has reintroduced a proposal for a real estate property tax. (Photo: Ceilidh Yurenka)

A proposal for a city transfer tax on real estate deals is back after its initial introduction two decades ago.

The tax might be targeted at commercial and residential property deals of more than $1 million, taking the money generated and putting it into the city’s Affordable Housing Trust for the creation of affordable units or preservation of units that might otherwise go market-rate, said councillor Tim Toomey, who reintroduced the idea Monday at a council meeting.

The council went along unanimously with his wish to refer the idea to the body’s housing committee for discussion.

The tax would likely be paid by property buyers, but first-time, middle-income buyers might be exempt, and “this is something that’s fluid and open to different ideas,” Toomey said. In exploring the idea two years ago, he was interested in applying the tax on “those coming to Cambridge to speculate on land.”

Any such tax would require the approval of the state Legislature, of which Toomey is also a member. In 2010, Provincetown voters approved a 0.5 percent transfer tax only to see the state quash it; the Cape Cod town has returned to the idea, though, as well as the creation of an affordable-housing trust to benefit from and apply the funds.

In Cambridge, where real estate is especially pricey and there’s an affordable-housing waiting list with thousands of households, “this would generate a substantial amount of additional revenue to earmark for affordable housing,” Toomey said.

Issues over the years

Although Toomey has discussed similar ideas for Cambridge since 1991, the idea got its most thorough debate in 1997 as properties that had been rent controlled reverted to market rates. Anticipating significant displacement among lower-income residents, councillors debated forming a fund to find new housing paid for by either a 1 percent tax on all property sales or a 1.5 percent tax on sales of properties going for more than $300,000. The council at the time was split on the idea, resulting in what frustrated residents called “gridlock,” according to The Harvard Crimson, while real estate companies feared the effect the tax would have on the market.

The history of Cambridge real estate, which has seen inexorable yearly surges in property prices and consistent sales no matter what real estate trends are elsewhere, bears out Toomey’s assessment at the time: “If someone can afford a $500,000 home, then they can afford the extra percentage added by the tax … People move into Cambridge for a lot of reasons. I don’t see the tax turning someone to another community.”

The fact that the originally proposed sales amount meant to trigger the tax was $300,000 fewer than 20 years ago “shows how much the times have changed in the city and how much real estate has seen an increase,” Toomey said Monday.

During public comment, title examiner Heather Hoffman called the tax “a great idea, but technically speaking, a nightmare” that could again face opposition at the state level as a home rule petition affecting only Cambridge, since a neighboring town such as Somerville could impose its own tax at a different rate and multiply the legal and record-keeping headaches at the Registry of Deeds.

Councillors seemed to look forward to exploring the idea in committee. They voted it on quickly, with only Nadeem Mazen and Dennis Carlone pausing to ask details or make brief comments.

“I agree something significant needs to change,” Carlone said.