If banks become a front in development debate, cafe comparison could be central

With its work on the rollout of Hubway bike rentals and an apartment tower proposal, CoUrbanize – a Kendall Square startup that creates websites to serve as meeting spaces for community projects and developments – has become a player in Cambridge civic life.

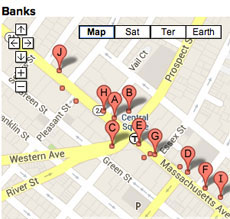

The CoUrbanize team of Karin Brandt, Daniel Weisman and David Quinn also posted Nov. 8 with a look at the “bankification” of city centers such as Harvard and Central squares, comparing the number of banks and cafes there and in Copley Square in Boston.

“Spaces of interaction – where people meet to share ideas, catch up and connect – are vital for urban neighborhoods. Banks have limited hours and are not open on weekends or evenings, leaving dark windows with no activity,” the blog says. “Thanks to online banking and electronic deposits, most people conduct the majority of bank business online or at an ATM. The number of times a person visits their neighborhood bank branch, rather than an ATM, are likely fewer than visits to a restaurant or cafe.”

In Harvard Square, CoUrbanize sees eight banks and four cafés. Central Square has an even more lopsided proportion, with 10 banks and three cafés The whole post is here.

Caps vs. frontage

The company’s take on banks lines up with that of city councillor Leland Cheung on why the increase in bank branches – despite their appeal to landlords seeking stable renters – is bad for a neighborhood.

“We’ve seen an explosion in the number of banks, which can go in and pay a higher amount of rent for a space, even though it’s predominantly vacant most of the time,” Cheung said as long ago as a June 2012 committee hearing, in addition to five times since in public meetings, asking city development staff what he could do “to cap the number of banks we have.”

The number of fast-food restaurants, or “formula-based businesses” in zoning lingo, is capped in Central Square and part of Kendall Square, but the Community Development Department resists taking that approach on bank branches. Stuart Dash, director of community planning with the department, has said the city prefers to limit banks’ presence by way of design: limiting how big a storefront financial institutions can take up. In the North Massachusetts Avenue zoning last year, city neighborhood planner Taha Jennings said the department thought 25 feet of frontage was the maximum that was appropriate.

Bank storefront skeptics

Cheung has been the councillor talking most about and against bank proliferation in the current term, in council roundtables and Ordinance Committee meetings, and proposing and urging ways to limit banks’ presence in the city. With the future of Central and Kendall retail likely to be voted in the coming City Council term, foes of bank storefronts – and that seems to be pretty much anyone asked their opinion – can also find examples of councillors Craig Kelley and Denise Simmons expressing favor for limitations on banks in ground-floor retail.

Barring a recount, the Nov. 5 election brings four wildcards to the conversation in winning challengers Dennis Benzan, Dennis Carlone, Nadeem Mazen and Marc McGovern.

Returning incumbent David Maher said the bank situation in Central and Harvard squares was worth study, but that the situation was an aberration – most banks are looking to close branches.

It makes sense that banks keep flocking to Cambridge’s bigger squares, the CoUrbanize team said. They locations have “high economic activity and consumer traffic,” such as tourists, and “particularly in places like Harvard Square, banks compete to sign student accounts because of the opportunity to secure lifetime customers.”