Recent bank turmoil shows why smaller banks are the smartest places to Move Your Money

Cambridge Savings Bank in Harvard Square seen in November 2020. (Photo: Marc Levy)

With inflation climbing, many Americans are beginning to feel uncertain about where they invest their money. When it comes to an ideal bank, they desire security, safety and trust, yet may just choose the bank that is closest – which will likely be a national bank, since they have more branches than community and regional banks.

It may not be wise to choose a bank based on location rather than by researching its benefits, though.

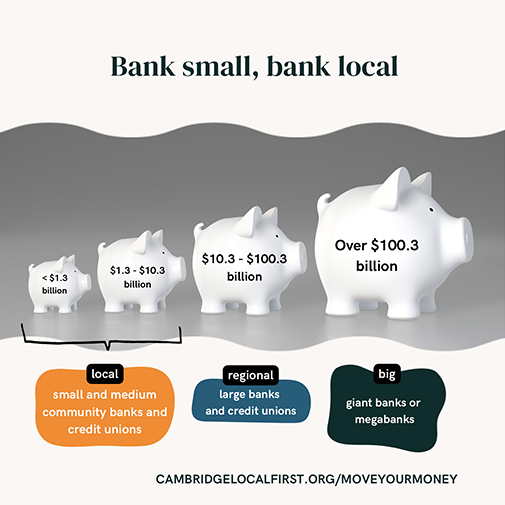

Before deciding, it is important to at least understand the differences between the three categories of banking.

Community: These are small and invest money into their local economy through its businesses and organizations. Banking locally gives customers lower fees, personalized attention and a full menu of services, Bankbound says.

Regional: A bigger scope than community banks, with branches in multiple states. Silicon Valley Bank was identified as a regional bank when it collapsed – and one that grew too big too fast. “When banks grow quickly, there are red flags everywhere,” said Dennis M. Kelleher, chief executive of Better Markets. “That’s because the management’s capacity and the bank’s compliance system seldom grow at pace with the rest of the business.”

National: These have branches globally and are the most well-known, with ranks including Chase, Wells Fargo, Bank of America and Switzerland’s Credit Suisse – which was forced to merge with competitor UBS after the collapse of SVB.

Why bank local?

Consumers may believe that banking big will provide them with more resources and support. That’s far from true.

Large banks “regularly charge higher fees,” are “less likely to lend to low and moderate-income buyers” and “generally take longer to process loan applications,” Banks.com said. With their influence, big banks do not need to make the effort to appeal to customers.

It’s local banks that maintain competitive fees and rates, often offer free checking accounts and free standard checking and waive fees for those who opt for electronic statements, according to The Balance,

Bigger banks have a higher risk of failure due to the larger sums they take on, which means they “have new rules to follow and face more scrutiny from regulators,” Bankbound said. “Many megabanks are still paying off billions of dollars in fines for breaking regulations.”

What is Move Your Money?

Michael Shuman, a member of the board of directors for the American Independent Business Alliance, says banking local and investing 1 percent of your life savings in local businesses, nonprofits and real estate projects is as recommended as paying off credit card debt. Start by shifting funds from large banks to small, community banks that invest in the city we love. By switching to local you can benefit as well as the small businesses that these small banks support.

This April, Cambridge Local First invites you to explore how banking locally can support a strong and resilient local economy. Move Your Money is a campaign that explains the benefits not only the community, but for individuals.

Move Your Money is dedicated to serving Cambridge residents and business owners. Sign up with the link at the bottom of the article to get updates about local banking in Cambridge.

If you have questions or want to start or continue a journey to banking locally, reach out to us through our social media platforms. You can follow us on Instagram, Twitter, Facebook and Linkedin to keep up with the Move Your Money Campaign, and visit our website to learn about the bank-local movement and sign up for updates.

Thank you to the Sustainable Business Network of Massachusetts and the Cambridge-Somerville Black Business Network for being a partner in support of this campaign.

Stacia Legacie and Catherine Callanan are students at Lesley University and interns with Cambridge Local First through the Resilient Local Economies program.